President Trump’s Immediate Emergency

When Donald Trump is inaugurated, he will immediately face an emergency that will potentially be the greatest crisis of his presidency. It involves the destabilization of both the global financial system and the daily economic exchange in all the world’s major economies.

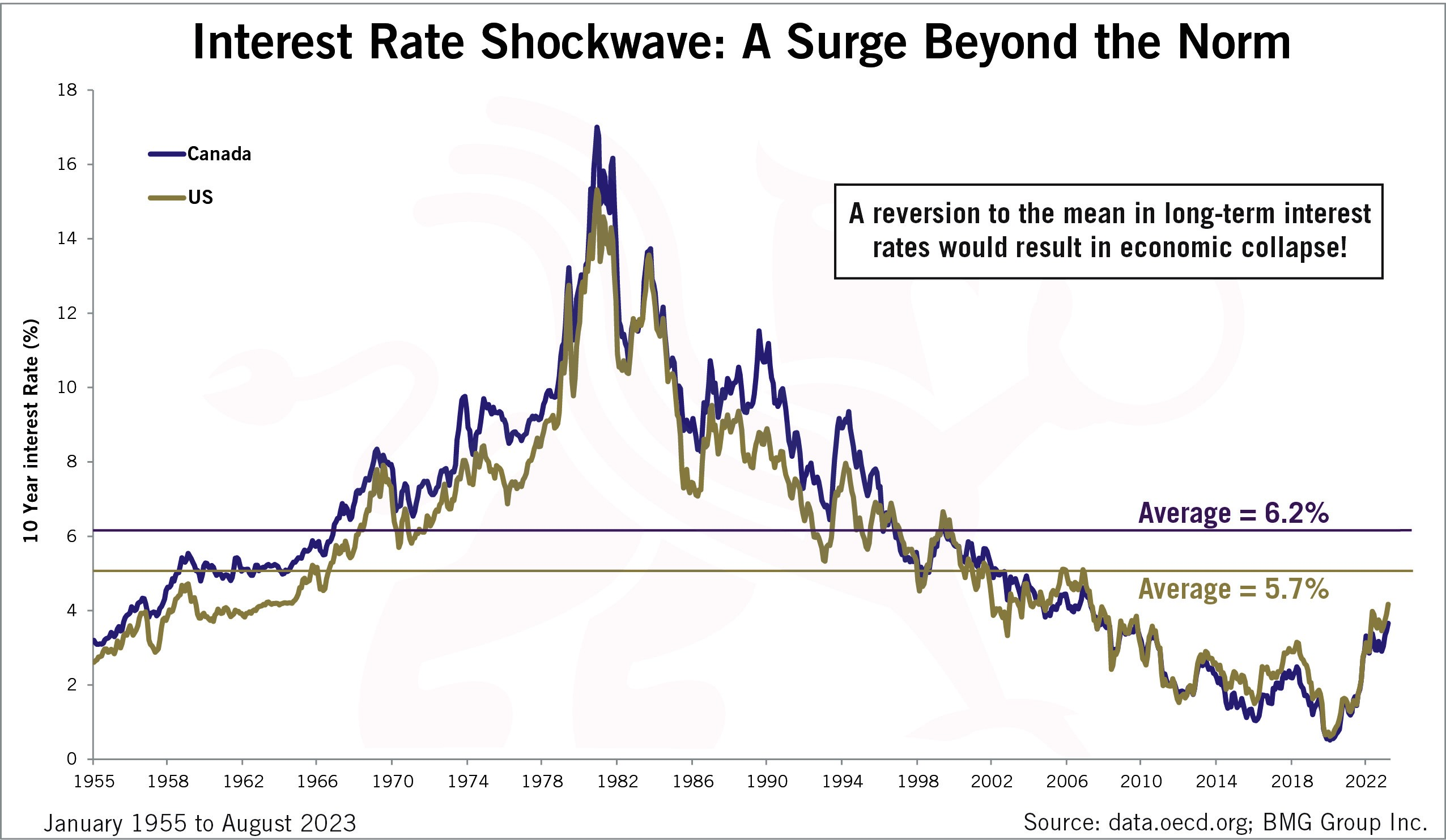

The onset of the crisis started in 2014 and is accelerating. At the core is the global debt bubble created by central banks’ destabilizing and low interest rates, creating an artificial market. The global debt bubble has increased to $230 trillion, or 340% of global GDP, up from historically stable debt levels of 150% of GDP. We have an unbearable $130 trillion of excess debt that will be cleared from the economic system.

The onset of the crisis started in 2014 and is accelerating. At the core is the global debt bubble created by central banks’ destabilizing and low interest rates, creating an artificial market. The global debt bubble has increased to $230 trillion, or 340% of global GDP, up from historically stable debt levels of 150% of GDP. We have an unbearable $130 trillion of excess debt that will be cleared from the economic system.

Jensen discusses the London Bullion Market Association, and how it allowed for the creation of paper gold contracts that could be sold without limit, thus suppressing the gold price. Increasingly low central bank interest rates became the norm as the gold price no longer rose to signal low real interest rates. Rising gold prices limited the prolonging of loose money policies by central bank regulators by drawing investors from paper money and bonds into gold, and this was no longer the case. The global debt bubble was born.

That Goldman Sachs, JP Morgan Chase, the Bank of England and the Fed are at the center of this market manipulation is a further complicating factor. The approaching financial market implosion is a predictable consequence of central planning and complete regulatory capture of central bank monetary policy, and complete capture of our economic and financial system.

Bond yields now indicate that monetary policy is tightening and, in debt bubbles throughout history, tightening of credit squeezes the debt-addicted economy, initiating debt bubble collapse and leading to market collapse.

Jensen discusses global monetary tightening that started in 2014 with increasing LIBOR, and sovereign credit tightening.